I was thinking about this last night. The reason why Coinbase and alike have such data available is because THEY are the ones performing the USD/BTC transaction for you. So they have the exact time and price in the record.

When you’re trading crypto for crypto, you’ve then both got to track the price of the original crypto being traded and then the fiat value at the time of the transaction (ETH -> BTC -> USD).

That in itself can be difficult, especially when you’ve got several sources to gather your BTC/USD value. Which source gives you the best price? Is it better to use the USD value from an exchange that has a lower price, or one who has a higher price?

Crypto is still very junior and unique when it comes to this kind of mindset. We’re so used to valuing things against the fiat value and now we have a 3rd value set to bring in.

It is of course very confusing. This is why I don’t trade regularly, and when i do, i keep everything recorded a the time of the transaction on a spreadsheet.

That being said, it’s relatively simple for me in the UK as it’s only a taxable event when i convert back to fiat. That being said, i still keep track of crypto to crypto transactions just to be safe.

3 Likes

@jcasale let me give you an example of how to figure out the worth of SFX at the day of earning. Might also be interesting for others.

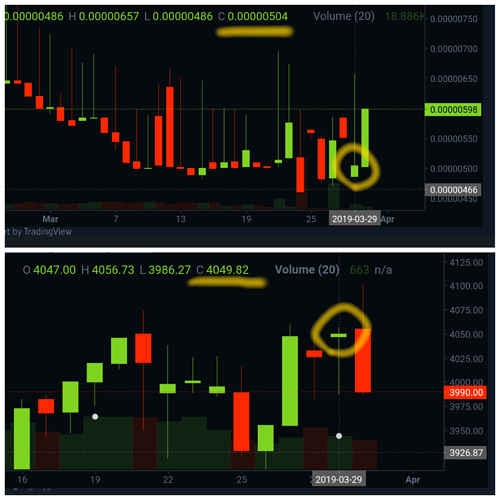

Scenario: I locked in my tokens anywhere in this year, unlocked them yesterday (March, 29th) and received 5000.23 SFX. I use the exchange Coindeal for evaluating prices.

-You check the charts for BTC/SFX and USD/BTC. You select 1D candles. When you click on a candle you can see the opening (O), high (H), low (L) and closing (“C”) price.

-We use the daily closing price for determination. Now I can calculate the worth of my incoming incentives.

-Multiply the amount of SFX by BTC/SFX price by USD/BTC price.

Our example:

5000.23 SFX * 0.00000504 BTC/SFX * 4049.82 USD/BTC = 102.06 USD

If there is a liquid Fiat pair for SFX available later, you can directly use that for price determination and don’t need the USD/BTC price anymore. Then you only have to multiply your SFX amount by the USD/SFX daily close on your desired exchange.

Now, what we have done is we have only evaluated the worth of our incentives at the time of receiving. I can not tell you how/if this is already taxable. In this case you will have to speak to an accountant. I can only sum up the possibilites - no legal advice.

The incentives may be seen as:

- “dividend” -> “dividend” tax on the worth of received incentives

- regular income -> income tax on the worth of received incentives

- something different -> other tax evaluation on the worth of received incentives

Now, when you sell your paid out SFX this might be a taxable process again. Since you didn’t buy those SFX there are three possibilities:

- cost basis is zero because you didn’t actually buy SFX

- cost basis is the price at the time of pay out (see above)

- cost basis is something different

Those thoughts are already going quite far. Personally, I will get in contact with crypto tax management projects and an accountant as soon as payout of incentives begin. Crypto in general is new tax territory and SFX incentives do not really fit into any category of crypto tax legislation yet. Keep in mind, it is technically a share of turnover / fee distribution rather than a “dividend”!

4 Likes

I’m from the U.S., it took a lot of time but I went back and manually entered my trades, etc. but I figure all that time is well worth it for Safex. What I use is a cryptocurrency tracking software. There are various ones out there that can analyze your profits and gains in real time. You can import CSV and other file types from exchanges. Or you can manually import each trade/buy/sell/mine/deposit, etc. which is what I do. When it comes to tax time with these websites you can download a Tax report when you are ready to file.

I am trying to figure out what the coming div/incentives should be labeled as either income or gifts. Honestly I don’t think the United States themselves even know right now in this situation. Technically Safex passes the Howey securities test. Also I’m having to manually enter in SFX and SFT and what they’re currently trading at since the crypto software website doesn’t. Hopefully it will soon when these coins are listed on CoinMarketCap.

I feel reporting cryptos in the United States is a good idea especially if you were to ever cash it out back to fiat in large amounts as it would throw up a lot of red flags as to where the money came from. Hopefully our tax laws will change in regard to this as people like John McAfee don’t think they can keep up with the complexity and private nature of the situation. Ideally it would seem the best thing the government could do is to allow people to pay their taxes in crypto if they deem necessary.

5 Likes

I think it is a real issue we should as a community address.

Would be great to start up a thread with some tools and needs: and we can see to it that these kinds of tools get implemented.

Please stick to generic needs such as: export to csv: which fields: which can be lived without but nice to have: so we can get to the core solution at least for start

Lucky for me I just left my SAFEX balance in the same spot since more than 3 years now: and will one day earn long term cap gains should I sell any part, BUT THE SFX: that will become a different story so tools to track our SFX earn outs will definitely be needed.

7 Likes

It sounds like you are looking for help on coming up with cost basis’s for your Omni token trades to which I say you are on your own. Coinbase does generate a 1099-k but that is for credit card purchases only. You need to calculate your own cost basis from each exchange and use a service like bitcoin.tax or something along there.

The other half of this convo is the safex cash dividend yield. Its still in the air what exactly is the taxable event here in the US.

@dandabek will dividend collection be recorded to each wallet daily or lump sum when you actually collect? If I dont collect dividends for lets say 3 months will there be a breakdown of each days rewards to calculate cost basis that way or will it be just taxed on that specific collection day cost basis?

I imagine if you are a store doing hundreds of thousands of dollars in SFX and made a small investment in SFT in the same wallet you have dividend collection and payments received it could get messy.

1 Like

If you have to send a collect transaction; I don’t know how tax authorities will have you record your receiving the funds, is it when it is assigned to you, but actually technically the funds get assigned to you only once you ask for them.

2 Likes

^ This. Very unique to the individual and country of tax.

For example, in the UK I’m only taxed once I convert any crypto back to fiat. So it doesn’t matter to me how i receive them as they’ll always be counted as a zero cost gain.

2 Likes

I would like to underline the importance of the questions above and a solution to these questions, as they are a major contributor to the success of the safex marketplace - If the fees are lower, but filing taxes is equal to unraveling the mysteries of universe, it might keep people away - the safex community is worldwide and together we can come up with some minimum requirements for the anonymous transactions by simply asking our accountants or IRS reps - Personally I’d rather see delay in marketplace release and get this right, than seeing the marketplace come online, but struggle to onboard merchants because of the tax challenge(s).

If not already done, please consider:

- The possibility to insert a message (e.g. invoice number) into any wallet to wallet transaction. Revenue services will generally accept invoices against referring transactions (unless one is under further investigation);

- Dividend transactions (automated or manually claimed) to include an automated message telling that this particular transaction is for dividend payouts time stamped from date of claim against date of previous claim. This to prove where the funds came from, as dividend tax is a different tax percentage than e.g. income tax in pretty much every country in the world.

3 Likes

To me all this talk is not much realistic, honestly, every merchant put some effort to organize the papers to pay taxes, its not the end of the world.

As long as you declare the right and can prove it…

3 Likes

@eddie995it

That’s a very limited view to my opinion. Balkaneum is bringing a revolutionary platform to the world where merchant fees are being brought down and automated, privacy with every transaction, the ease of an international transaction, etc. Why not go one step further and make life for the merchants a lot easier by creating/ adding a few lines of coding to achieve that?

I’ve gone through some tax regulations around the world and one of the most unfair ones I found is applied in Europe, where your crypto holdings tax calculation over e.g. 2018 is done by taking the value of that particular cryptocurrency on the 1st of January 2019. Taking the 2017 bull run as an example, taxation on 1 bitcoin earned $962 on January 2nd 2017, was taxed X percent on $13,500 (value Jan 1st 2018). If this is taxed around 30%, the taxation value exceeds the actual purchase value . Since the majority of internal revenue services around the world only accept local currency, I think you can see the necessity of being able to track the crypto pricing against a fiat currency preferably by the second to be absolutely sure the IRS doesn’t get too much of your crypto earnings - provided one keeps his/her/its holdings in crypto. If one would do 100,000 transactions a year, you can imagine how much work it is to ‘compare’ your crypto sale against a fiat currency on the date of that sale. Not to mention the time needed to verify 100,000 transaction individually if one would go for the actual time of the sale. A semi- or even fully automated process would most certainly be very welcoming to future safex marketplace merchants.

That a merchant should put in some effort to file the right taxes, I agree. Though when one is building a revolutionary economy like the safex marketplace, I think adding such features certainly should be up for consideration and if it was up to me, a MUST to be implemented. If lower fees are in place, but the man hour costs of preparing taxes are significant, it might not be worth to change platforms - see it as the people who drive 200 km to get a particular product $2 cheaper and think they had a good deal. Merchants don’t think like that; all costs are taken in consideration to maximise profits - at least good ones do.

4 Likes

“europe” is not a single country, in UK is not like you described, in Italy too. You may end up developing/integrating a lot f different set of taxation models, and it’s not even guaranteed such model would be accepted like you said such state only take in consideration first day of the year. What is the point of all this?

4 Likes

I’m not advocating implementation of individual taxation regulation per country for the safex marketplace, but a simple feature to make a tax declaration easier. A simple wallet based ledger displaying transaction number against invoice number and safex’ (local) fiat or Dollar value at the time of the transaction already is a great help.

A quick search showed that e.g. Italy (I assume you are Italian) has a 26% dividend withholding taxation and income taxes ranging from 23-43% (source: Deloitte). I am pretty sure you would like your dividends to be taxed at 26% rather than 43% (if applicable). Try convincing your IRS agent that this ‘blank’ transaction credited to your wallet should be taxed as dividend tax rather than income tax. Imagine you’re from a country where dividend tax is non-existent or very low and your income tax is at 20%.

That’s why so many web stores ask to enter ‘gift’ in a paypal transaction; gifts up to certain value are tax-free if ‘purchase’ is chosen that transaction will come under income tax, etc.

2 Likes

keep it simple approach: there is a basic form we should be bale to generate from a wallet, of course a big merchant will have their own infrastructure to add a system that matches to them.

We can crowdsource bounties to tax knowledgeable people in the specific places, and then to developers: make a spec, and have it added into a wallet.

5 Likes

Indeed a basic and simple feature is enough. IRS’ all over the world have similar minimum requirements - I am confident that one of those is to show the reason why funds were credited to your wallet. As @eddie995it already indicated, merchants should obviously put in the majority of effort to get their tax declarations right.

Italian taxation is different @dogberry, La normativa di riferimento è quella contenuta nell’art. 67 del Tuir e quindi le plusvalenze derivanti da conversione di valute virtuali, per effetto di operazioni a termine o a pronti, sono tassabili se la giacenza media sull’insieme dei conto correnti o depositi (in caso di valute virtuali si fa riferimento ai cosiddetti “wallet” ossia ai portafogli elettronici) ha superato per almeno sette giorni lavorativi l’importo in euro di 51.645,69. so you pay 26% on capital gain only if all of your wallet combined have a fiat value of more than 51k on a sustained time of a week

Also there is no “security” or dividend aspect in italy for crypto, every cryptocurrency is equal to bitcoin and so is considered as foreign currency.

something like a filtered tx history option within the wallet would be good enough. Then one could separate the “dividend” incoming SFX transactions apart from other regular incoming SFX transactions.

Something like: show “SFT unlock transactions” then it gives you those with the unlocked SFT and paid out SFX only

2 Likes

My Italian is rusty, but as how I understand this particular section you posted, is for having crypto as an investment - when one would use crypto as full income, taxation likely is different.

1 Like

I think it matters when you claim your residue; If it is collecting but you dont take it off of the table is it yours?

Unlike with mining, you mine a block and you’re ready to go; in this case you need to claim the incoming.

If you work, and your paycheck is received 3 months ago you dont have income until you’re paid right?

5 Likes

when you use btc to get paid for goods or services taxation is equal to local fiat, you have to give receipt or invoice