True BUT…there are only certain things you will want to buy when there is no recourse for you.

what do you mean? like you can’t buy a car or a house? lol

In Oz it will be hard as they tax when you transfer house or car and tax on sale price. Even though we all think big ticket items wealth etc. Crypto will fail in that environment as new people are aspiring with BTC. Cryptos origins and i hope Safex success will come from day to day use and paying for services, food, fuel. Live tax free this way, wages into safex etc.

Yeah for SAFEX car & houses are out of the question, cause you need paper work for those.

But everything else is possible.

Just ask yourself what are all of the things you would be prepared to purchase without any means of reclaiming your money back, without any way of appealing, next, consider a business and how it accounts for expenditure, next think about how a business accounts for an asset which was purchased and which ended up in a loss of life because it malfunctioned, no recourse, no insurance. These are the constraints I am talking about.

First point is definitely a concern.

As for the insurance, that’s dealing with more industrial assets like heavy machinery etc.

Businesses only need to account for expenditure for tax benefits. If you’re not paying taxes in the first place, you’re already ahead.

80/20 rule. The majority of goods/services sold on SAFEX is going to be normal goods you buy on Amazon or eBay.

Yes crypto like other assets is attracts capital gains tax when sold in Australia.

If < 1year since buying the capital gains is added to your taxable income and taxed as normal earnings.

If > 1year then the capital gains is halved and the half is added to your taxable income

The capital gains is calculated by taking the sale price less expenses to sell the asset and then less the cost to buy the asset.

So if your crypto cost you 25K AUD to buy and then you sell for 40K AUD back into cash the capital gains was 15K (assuming no expenses to sell).

- Held less than one year That 15K AUD is added to your taxable income.

- Held Greater than one year it is halved and 7.5K AUD is added to your taxable income

So the tax on it is anywhere from 0% to 50% depending on your base taxable wages. And by holding for over a year then 1/2 of the profit is tax free

Thanks for that info

Safex should have a credit card. So when u cash out the payout goes onto a credit card. Would that work

You could also use localbitcoins.com

Trade your safex for BTC then use face to face cash to get cash for btc. I’ve heard that works well. I used them to buy my BTC years ago

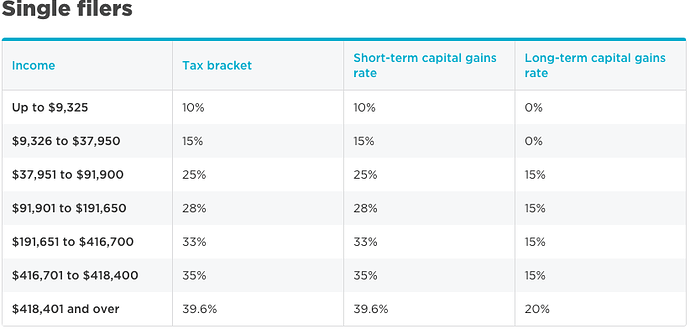

My goal is to buy enough SAFEX that I can get up to $37,950 per year and withdraw using the long-term capital gains rate of 0%.

Open up a side freelancing business & report taxes using the business so it doesn’t cut into the personal taxes.

Do you have a Tenx Debit Card Cryptomanic?

Perhaps a tumbler built in so we can cash out so no one knows who people are . Cards are going draw attention because you will need id an other info.

I

Sorry that becomers (trader) earnings and taxed that way as far as I understand things

There’s a huge debate on reddit about this subject, I think the consensus is that you’re still responsible for capital gains taxes.

Huh? I didn’t understand that sentence lol

Are you in the United States? I asked because TEN X only allows those not from the USA to get the credit card for Ten X Wallet

Can you provide the Reddit link if at all possible Thank you

If you have an asset that you purchase then sell later on then that is governed by capital gains tax in Australia

If you have an asset that you are earning off, either by trading (buying/selling) or residual income then that is earnings.

What you described was not buying an asset then later on selling the asset, but rather residual income. So its taxed in Australia as taxable earnings.

Obviously if you get the $$$s without declaring it then you wouldn’t be paying tax. But the question (and thus the answer) was assuming it was being declared. A “card” that is anonymous would not be declaring it would it.