Hello Community,

I did some more detail work of setting up a model that let’s us estimate the total amount of lost Safex Cash and Safex Token in the TWM ecosystem. Therefore, I made the following approach:

- Assumption 1: All circulating SFT are continuously staked.

- Assumption 2: The quarterly Velocity of Money (qVoM) for SFX is always 10.

- Assumption 3: A relative ratio of 0.5% of each last year’s circulating SFT supply is lost every year beginning with year 3.

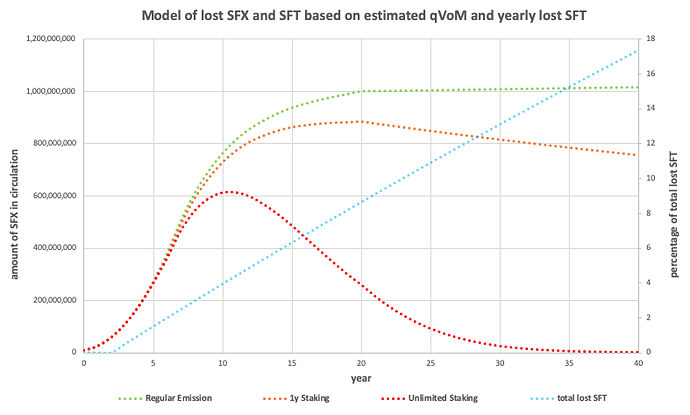

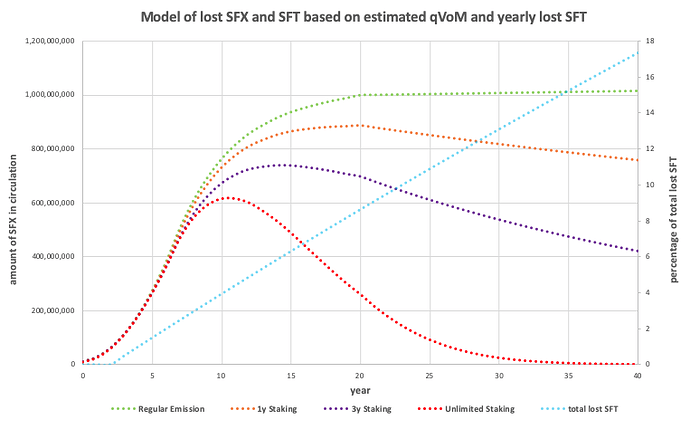

Based on these assumptions, a model can be set up displaying the following 3 edge cases:

-

Green scenario: Assumption 3 is not fulfilled. No SFT is lost at all. All mined SFX will stay in circulation forever. The circulating SFX supply is matching the theoretical supply from the blue paper in each year.

-

Orange scenario: All assumptions are fulfilled. The staked SFT that are lost remain staking for their 1 year intervall - then they stop collecting/reserving interest.

-

Red scenario: All assumptions are fulfilled. There is no fixed staking intervall. Once tokens are staked, they collect/reserve interest forever.

-

The light blue curve shows the total amount of lost SFT based on the yearly lost rate of 0.5%.

Based on the output of this model and the resulting graph the following key findings can be made:

-

In the first few years it makes no vast difference in the circulating SFX supply whether lost SFT are staking forever or only for one year for the set parameters.

-

The amount of circulating SFX reduces rapidly when the time interval is long enough and the set parameters result in a higher output (staking rewards of lost tokens) than input (emission via block reward) of the ecosystem.

-

SFX will become very likely a deflationary asset at the end of the regular block reward schedule in the future, even when a tail emission is existent after year 20.

-

An increase of the parameter qVoM (10) and/or yearly lost SFT ratio (0.5%) will result in a stronger effect -> circulating SFX supply will go down more rapidly because output of the ecosystem gets higher.

Let me hear your thoughts. If you want to set other values for the parameters qVoM (10), yearly lost token rate (0.5%) or tail emission (2 SFX/block) after year 20, I will put those in the model and post the chart. The model can also be adapted so that lost coins are allowed to collect/reserve interest for a different time interval (3y, etc).

(Limitation of the model: In edge cases the circulating supply can even become negative as the accumulated locked SFT demand more SFX than the circulating supply for high qVoM and date in the far future. For this cases, the interval of the data pairs (currently 1y) has to be reduced to months/weeks, so that the SFX demand by locked SFT in the new interval is less than the circulating SFX supply again.)

6 Likes

The red scenario is detrimental to long term sustained activity.

I am wondering if you factored in the 3 SFX per block that are still produced after year 20. While significantly less than any of the block rewards along the curve, it can still provide a buffer to situations where currency becomes overly scarce where you can not use it.

Also please keep in mind that the decimal 0.0000000001 is very expansive in terms of units of supply available to the ecosystem.

Excellent model as well can clearly see the path from here that is important to have dynamic stake/unstake as well as a time limit after which you must take some action (simple restake command) in order to continue to accrue beyond that limit.

5 Likes

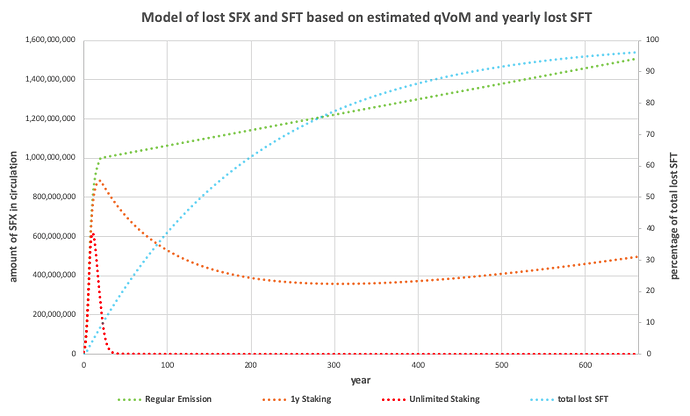

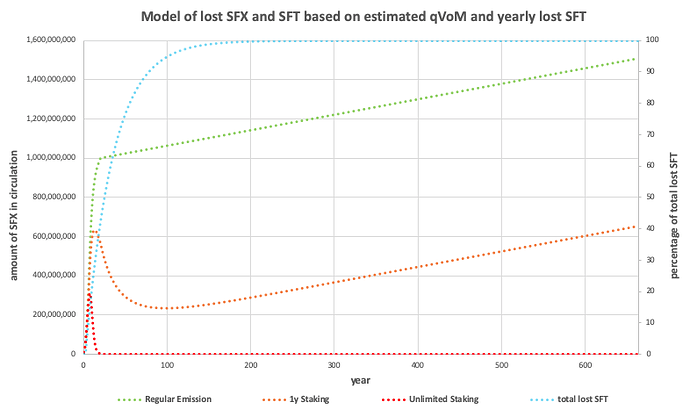

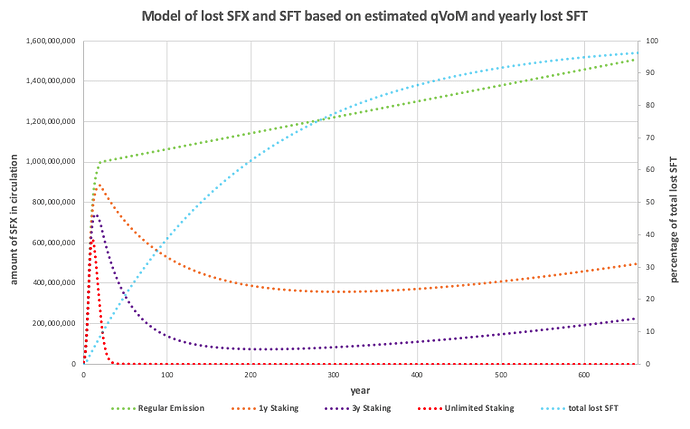

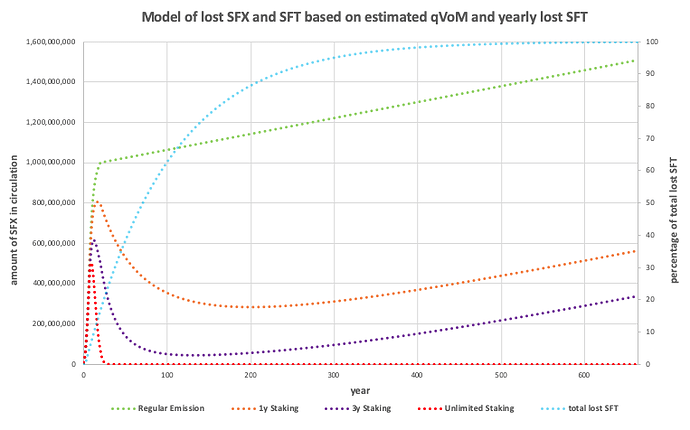

3 SFX/block tail emission is factored in here now after year 20, I had set 2 SFX/block in the above post - edited now to 3 SFX/block as well. This is the very long term outlook for this model.

- qVoM = 10, yearly lost SFT rate = 0.5%

- qVoM = 10, yearly lost SFT rate = 3%

It shows, that with a staking cutoff date, there will always be a good amount of SFX in circulation, no matter how big the yearly lost SFT rate is. The special appearance of the orange curve in the middle section describes where the tail emission is taking over and circulating SFX supply can grow again, since the lost locked SFT percentage is going down relatively.

P.S.: I know it is a bit ridiculous to chart 600y into the future. The goal was to show where the numbers converge to based on the set parameters.

P.P.S.: Someone in the forum today compared the loss of circulating SFX with a coin burn - the thing is, that in this case, it is a coin burn of a multiple of the supply based on the velocity of money. Therefore, circulating supply will always converge to zero long term as long as all inactive SFT are allowed to collect interest forever. An increase of block reward does not work against this phenomenon.

What does multiple of the circulating supply mean? Based on a qVoM (10) and the fee factor (0.05), the pool demands 4 * 10 * 0.05 = 2 of the total supply as a fee input. If 50% of staking tokens are lost (very long term in the future) then the pool demand of those lost coins is half of aboves equation output = 1. This means, that those lost staking coins theoretically demand the full circulating SFX supply within a year as their fee share. In this edge case, the lost SFX rate is higher than the circulating supply, and therefore circulating supply would become negative.

Example: qVoM = 20, yearly lost SFT = 3%. In this model, the orange curve dips at 69M SFX in the year 81, then the circulating supply increases again.

5 Likes

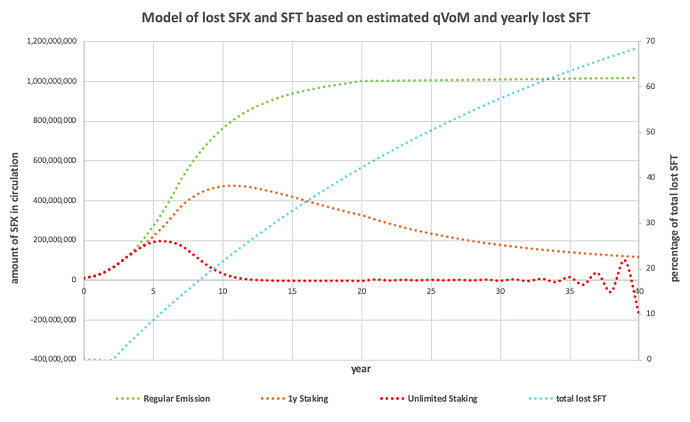

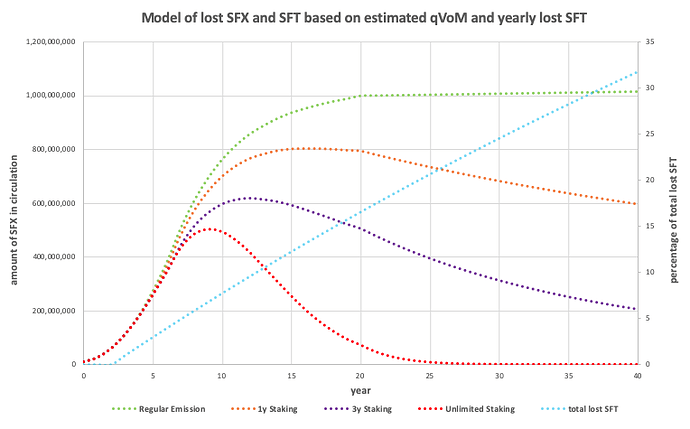

Model includes now a 3y Staking Time Limit. Assumptions as above.

- qVoM = 10, yearly lost SFT rate = 0.5%

- qVoM = 10, yearly lost SFT rate = 1.0%

As expected, a 1y Staking Time Limit results in a higher circulating SFX supply than a 3y Staking Time Limit.

Note: The model is still quite simplified, it counts all newly mined SFX and actively staking rewards as circulating supply available for TWM, which is not the case. Mined coins are in miners hands who decide to sell or hodl, same goes for staking rewards from active stakers. It doesn’t take into account SFX spot price surges because of lack of supply on the exchanges. Market Price goes up -> less SFX are needed for the purchase of fiat price pegged products -> SFX VoM decreases when spot price increases (for constant fiat TWM volume). Still it gives a very good idea about how the circulating SFX supply is affected by these parameters.

4 Likes

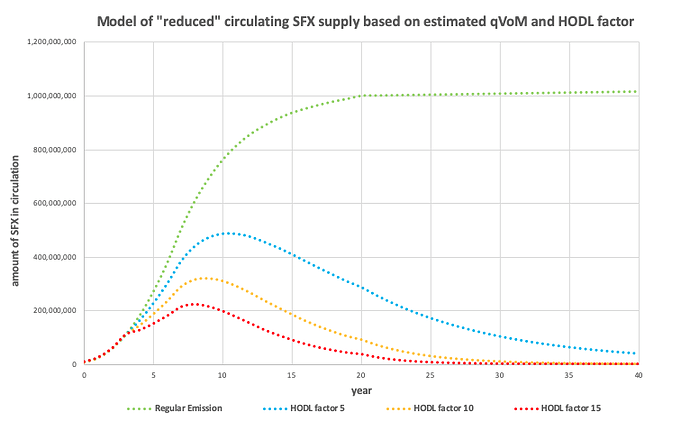

Slight modification of the model, introducing the HODL factor.

- Assumption 1: All SFT are continuously staked/restaked beginning with year 3.

- Assumption 2: No SFT are ever lost.

- Assumption 3: There is a constant ratio of staking rewards that is not sold by their owners in the near future (the HODL factor). A HODL factor of 5 means that 5% of yearly staking rewards go into long term hodler’s wallets who will not sell in the near future regardless of the market price of SFX.

- Assumption 4: qVoM is constant (10). Market price for SFX always adjusts so this is fulfilled.

The chart shows the “reduced” circulating SFX supply available for buyers and sellers on TWM. The circulating supply is not actually reduced, since the coins are in active addresses which keys are not lost. However, since they are effectively not available for TWM anymore, the market price of SFX has to rise accordingly when qVoM and GMV are set to be constant. (Example: If the supply “reduces” 50% in one graph, the SFX market price has to double.)

The model shows that the price of SFX can be expected to rise after the times of big block rewards are over in case the HODL-spirit of crypto is also existent in the SAFEX ecosystem.

- SFX available supply for TWM ecosystem will be significantly lower than full circulating supply.

- SFX supply on TWM will very likely turn deflationary after the biggest block rewards.

- SFX price is expected to increase significantly based on this model.

- Once certain price levels are reached because of these effects, some HODLers are expected to sell off part of their SFX staking rewards and let it flow back into the TWM ecosystem.

5 Likes