STEEM is a new network software where participants are invited to post articles and receive rewards in the form of STEEM tokens. Distribution of the tokens is determined by users voting on the content that they determine to be most relevant, and each of the voters, original posters, and replier will receive rewards for their contribution. It has come under our radar recently as a rising star on the list of alt coin market capitalizations ranking third within a short duration of time. We’ll get into how STEEM operates on a token level and how its distribution mechanics affect the market.

As an overview, the STEEM platform allows people to submit their article of text and pictures which gets stored to the STEEM blockchain. Users are then able to upvote the content they like as well as the responses to the original post. Payouts take place after votes have occurrend on a piece of content, and new substantial votes delay the moment of a payout. Once a payout moment has been reached the content producer, the voters, and responders are paid out in tokens that are denominated as 50% Steem Dollar and 50% Steem Power. The more popular your content the greater your share of the payout will be yours during a payout interval. We will get into what both Steem Dollar and Steem Power are.

The Steem platform has three different tokens that are relevant to its operation. The first is Steem which can be purchased currently on Bittrex exchange. Once someone has Steem they can “power up” their Steem a process which encumbers the token and converts it to what is called “Steem Power”. Steem Power is a token that enables you the right to vote on matters pertaining to the Steem platform as well as earn additional Steem Power and Steem Dollars from the platform. Steem Power holders are voting primarily on content as well as other elements we will discuss further shortly.

In addition to Steem Power, the Steem platform has a third token known as Steem Dollar. Steem Dollar is created at the moment of a payout to content producers. Steem Dollars are automatically throttled by the block chain network. Depending on the supply of Steem and it’s price determines how many Steem Dollars will be in circulation. The Steem system targets a ratio of 1 Steem Dollar for each 19 Steem Power. Steem Dollars can only purchase Steem so someone who has not converted their Steem into Steem Power can sell their Steem for Steem Dollars and earn interest from Steem Dollars.

Rewards to content producers is determined at a target of 10% of the market capitalization of the network over the course of a year.

The origins of Steem came from Proof of Work mining. During the first 864,000 blocks of the Steem block chain 40 Steem tokens were distributed directly to miners through an innovative Proof of Work queue system and an additional 40 Steem tokens were produced for a content and curation seed pool. The mining rewards are now at a rate of 1 Steem token per Block confirm instead of 80 as prior to the 864,000th block.

Approximately 69 million of the tokens were distributed in this way. Now that Steem have become converted to Steem Power, additional Steem is being generated through the various reward mechanism the platform has integrated. This totals to approximately 800 Steem produced per minute.

Rewards come to Curators, Content Creators, Block Producers, Successful Submition of Proof of Work, and Liquidity Providers. Each of these activities produces 1 additional Steem to the network, except the successful submition of proof of work which awards 0.0476 per block. However, for each 1 Steem produced through these mechanisms, an additional 9 Steem are generated and divided among all of the Steem Power holders. There are percentage based thresholds to produce a definite percentage increase in Steem supply for each of these Steem token generating activities.

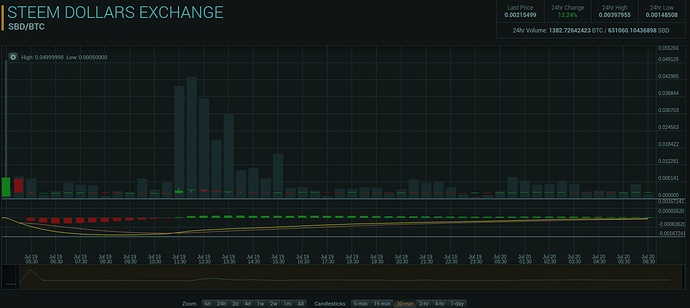

Relevant to Steem Dollars is a mechanism that determines how many Steem can be sold for Steem Dollars where Steem tokens are burned if the value is increasing, and Steem are created further if the value is decreasing. This is to maintain a stable meaningful value to the incentives for rewards. Another interesting feature to Steem Dollars is that liquidity providers earn Steem for being the top volume producer within a given hour to the tune of 1200 Steem, this is to incentivize participants to monitor the market and take on trades for users of Steem/SMD pair.

Over the course of a year Steem supply doubles; however, if all participants remain in the Steem Power mode with their Steem, then effectively this doubling remains in the hands of the original owners of Steem Power. This system collectively could be what leads to a well oiled motor for this uncensorable, decentralized, content network all held within a blockchain.

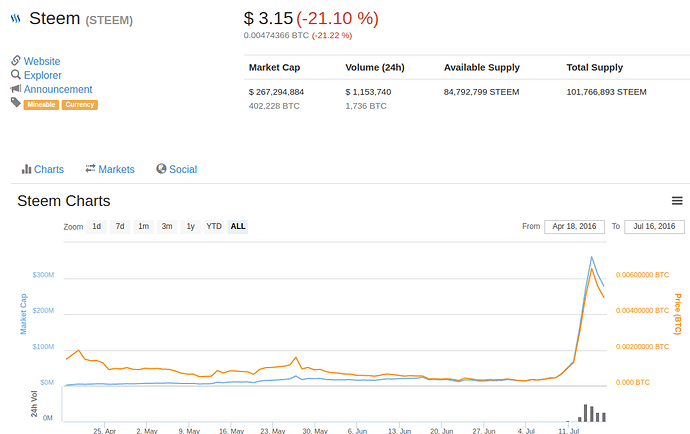

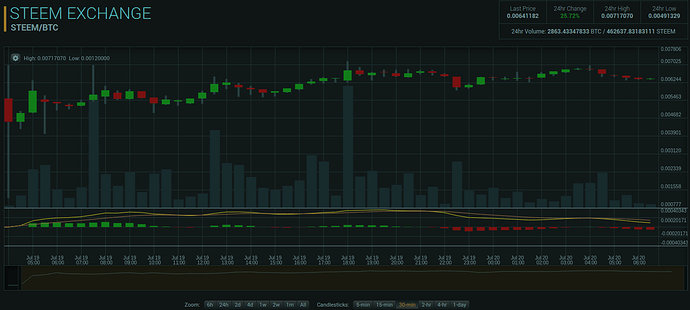

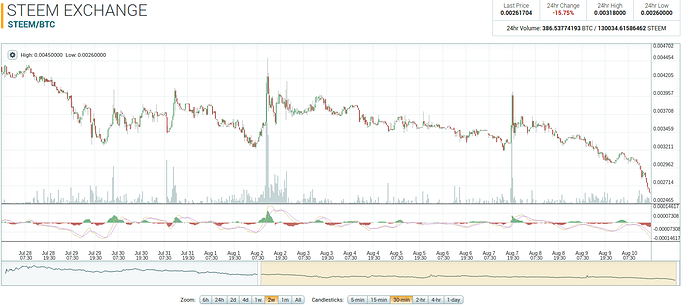

The price of Steem has risen from a low point of 0.00027 btc/steem to a height of 0.0075 btc/steem, an astounding 27x increase over the past week and it is third on the list by market capitalization.

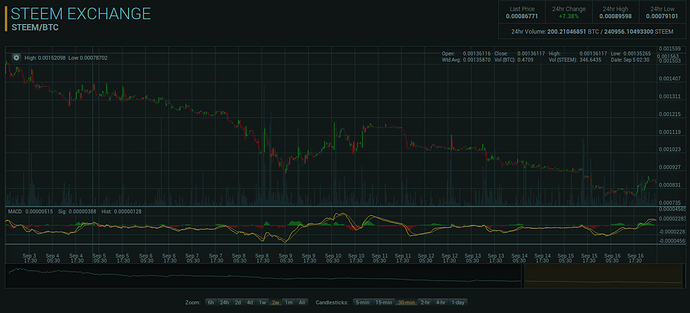

The rise in the coin can be attributed to its current scarcity due to some factors. First is that the majority of the initial token has been available through mining. This took place to “seed” the initial community that will then participate in the voting process and therefore the distribution process of rewards, an essential need that has been met. This token, Steem is converted to Steem Power which takes 2 years to convert back to Steem if someone wanted to liquidate it back to Bitcoins or into Steem Dollars. Once you purcahse Steem and convert it to Steem Power, you must wait for rewards to see returns to your investment.

A second reason to a rapid rise in price could be attributed to the internal market that trades Steem for Steem Dollars. The Steem Dollars can only be used to buy Steem which means that participants who received Steem Dollars will directly use those tokens just only to purchase Steem which only then can be liquidated for Bitcoin or Fiat. What this means is that there is a price feed that is trading in a single direction, i.e. buying Steem.

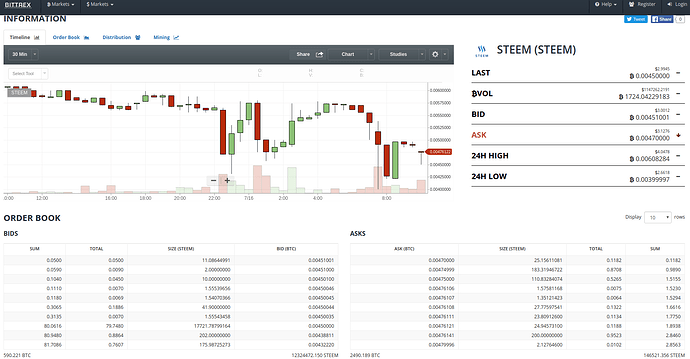

From a speculators point of view, there is very little Steem available to purchase on the only exchange: Bittrex so the propensity of the price is to rise due to few existing and high placed sell orders of a token that may likely end up becoming encumbered for two years.

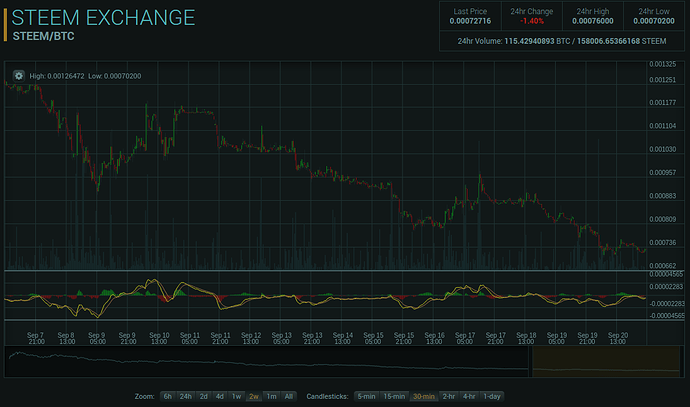

Something very significant about this suggests that Steem is not a platform intended to be a speculators haven. It is clear that there is room for professional traders to be involved and do a positive duty for the Steem community in the form of market making on the Steem Dollar market. This is one way to benefit from the Steem platform.

The clear and obvious way to benefit from the Steem platform is to post content that people find useful to them. This is another clear and direct way to participate and receive Steem rewards from the Steem platform. Certainly the prevailing price rise has occurred, though it is in my opinion that it will be quite stable and fluctuate only to accommodate further adoption of the platform, therefore the most effective way to gain from Steem is to be an active participant in its community. If you’re a market buff, checking into the Liqudity provider rewards, a whopping 1200 Steem per hour, and if you’re in Reddit or other forms of social media, then making posts and engaging the Steem audience is a sure way to gain from this exciting and new form of crypto economic system that has a novelty that any crypto enthusiast should check out.

An indepth on the system can be found here: https://steem.io/SteemWhitePaper.pdf

only way to be in it was to participate by writing articles.

only way to be in it was to participate by writing articles.